Aug 2, 2023The equation for its expected return is as follows: Ep = w1E1 + w2E2 + w3E3. where: w n refers to the portfolio weight of each asset and E n its expected return. A portfolio’s expected return and

The Investment Playbook for 2024: Visualized

The expected return on a security rewards investors for the time value of money and market risk. These are factors that impact investment returns and can’t be eliminated by diversification, unlike specific risk which can be reduced through proper portfolio management. Therefore the correct option is A. Explanation:

Source Image: binance.com

Download Image

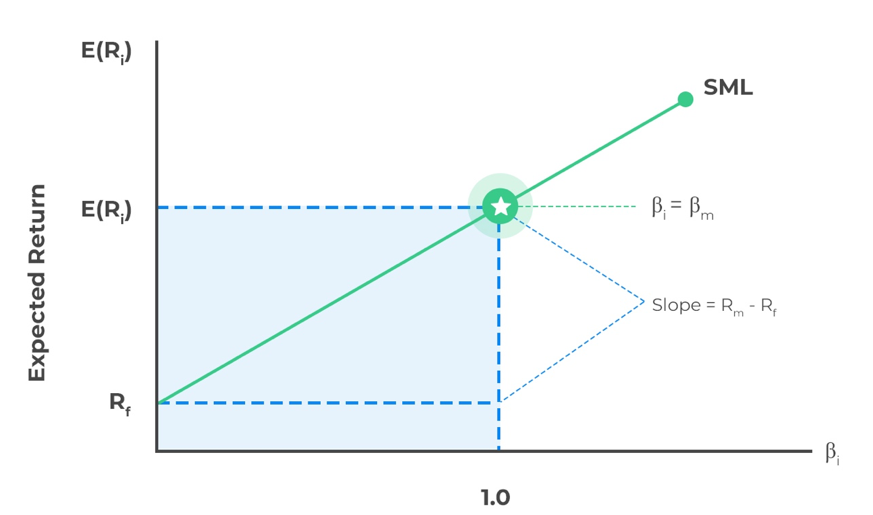

All Answers (2) For individual securities use security market line and its relation to expected return and systematic return (Beta) to show how the market must price individual securities in

Source Image: towardsdatascience.com

Download Image

7 Staff Incentives That Help Keep Talent On Board

Sep 26, 2023The expected return is the amount of profit or loss an investor can anticipate receiving on an investment. An expected return is calculated by multiplying potential outcomes by the odds of them

Source Image: toptal.com

Download Image

The Expected Return On A Security Includes A Reward For

Sep 26, 2023The expected return is the amount of profit or loss an investor can anticipate receiving on an investment. An expected return is calculated by multiplying potential outcomes by the odds of them

Aug 2, 2023An expected return and a standard deviation are two statistical measures that investors can use to analyze their portfolios. The expected return is the anticipated amount of returns that a

Investor Psychology: Behavioral Biases | Toptal®

PORTFOLIO EXPECTED RETURN The expected return of a portfolio is the weighted average of the expected returns of the respective assets in the portfolio You can also nd the expected return by nding the portfolio return in each possible state and computing the expected value as we did with individual securities , & ) 3 & &

Sharpe Ratio, Treynor Ratio and Jensen’s Alpha (Calculations for CFA® and FRM® Exams) – AnalystPrep

Source Image: analystprep.com

Download Image

How Binance Protects Your Funds With Risk Control Measures | Binance Blog

PORTFOLIO EXPECTED RETURN The expected return of a portfolio is the weighted average of the expected returns of the respective assets in the portfolio You can also nd the expected return by nding the portfolio return in each possible state and computing the expected value as we did with individual securities , & ) 3 & &

Source Image: binance.com

Download Image

The Investment Playbook for 2024: Visualized

Aug 2, 2023The equation for its expected return is as follows: Ep = w1E1 + w2E2 + w3E3. where: w n refers to the portfolio weight of each asset and E n its expected return. A portfolio’s expected return and

Source Image: visualcapitalist.com

Download Image

7 Staff Incentives That Help Keep Talent On Board

All Answers (2) For individual securities use security market line and its relation to expected return and systematic return (Beta) to show how the market must price individual securities in

Source Image: talentlms.com

Download Image

21 effective Ideas for Employee Rewards and Recognition Program

Expected return is calculated by multiplying potential outcomes (returns) by the chances of each outcome occurring, and then calculating the sum of those results (as shown below). In the short term, the return on an investment can be considered a random variable that can take any values within a given range.

Source Image: possibleworks.com

Download Image

Changes Coming to Fortnite Save the World’s Daily Reward System in v25.10

Sep 26, 2023The expected return is the amount of profit or loss an investor can anticipate receiving on an investment. An expected return is calculated by multiplying potential outcomes by the odds of them

Source Image: fortnite.com

Download Image

9 Examples of Social Engineering Attacks | Terranova Security

Aug 2, 2023An expected return and a standard deviation are two statistical measures that investors can use to analyze their portfolios. The expected return is the anticipated amount of returns that a

Source Image: terranovasecurity.com

Download Image

How Binance Protects Your Funds With Risk Control Measures | Binance Blog

9 Examples of Social Engineering Attacks | Terranova Security

The expected return on a security rewards investors for the time value of money and market risk. These are factors that impact investment returns and can’t be eliminated by diversification, unlike specific risk which can be reduced through proper portfolio management. Therefore the correct option is A. Explanation:

7 Staff Incentives That Help Keep Talent On Board Changes Coming to Fortnite Save the World’s Daily Reward System in v25.10

Expected return is calculated by multiplying potential outcomes (returns) by the chances of each outcome occurring, and then calculating the sum of those results (as shown below). In the short term, the return on an investment can be considered a random variable that can take any values within a given range.